Inflation helps rate call, manufacturing slows for fourth month in a row

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

Inflation print hurts rate cut chances

Manufacturing sales beat, still ugly

Chartwell’s $300M senior living deals

Loblaw to benefit from obesity?

IMP jumps 25% on new coverage

BEP inks 3 GW deal with Google

HOT OFF THE PRESS

Inflation print hurts rate cut chances

June’s CPI print tracked in-line with expectations, with headline inflation of 1.9% inching higher versus May’s 1.7% and core trim holding steady at 3.0%.

Most categories moderated versus last month’s reading, with the exception of clothing, health care…

… and transportation, which remains down Y/Y but to a lesser degree - as the drag from gasoline prices improves.

With this print being the last big data point before the BoC’s rate decision at the end of July, chances of a cut are now next to nil.

For category breakdowns, go here: https://www.bullpen.finance/content/204

Manufacturing sales beat, but still ugly

Manufacturing sales of ~$69B fell 0.9% M/M, better than estimates of a 1.3% drop. May marked the fourth straight monthly drawdown and the lowest reading in 2.5 years - driven mainly by petroleum, coal, and machinery sales.

Partly offsetting the weakness was the aerospace industry, which jumped 7% and drove the 0.4% decline in unfilled orders…

… as well as a 0.7% M/M inventory build. At 1.75x, the inventory-to-sales ratio sits at the highest level since the pandemic, as tariffs pressure sales volume.

While the soft manufacturing backdrop should keep a lid on wholesale sales in the near-term, May’s print surprised to the upside too - with 0.1% M/M growth beating expectations for a 0.4% decline (excluding petroleum).

Chartwell to spend $300M in Quebec

On Monday Chartwell Retirement (CSH-U) announced a string of new investments to grow its retirement footprint in Quebec. The deals follow announcements from Sienna (SIA) and Extendicare (EXE), as the senior living industry takes center stage.

For more details on why the sector has a bid, check out the full bite below.

If the above link doesn’t work, try this: https://www.bullpen.finance/content/203

FUNNY BUSINESS

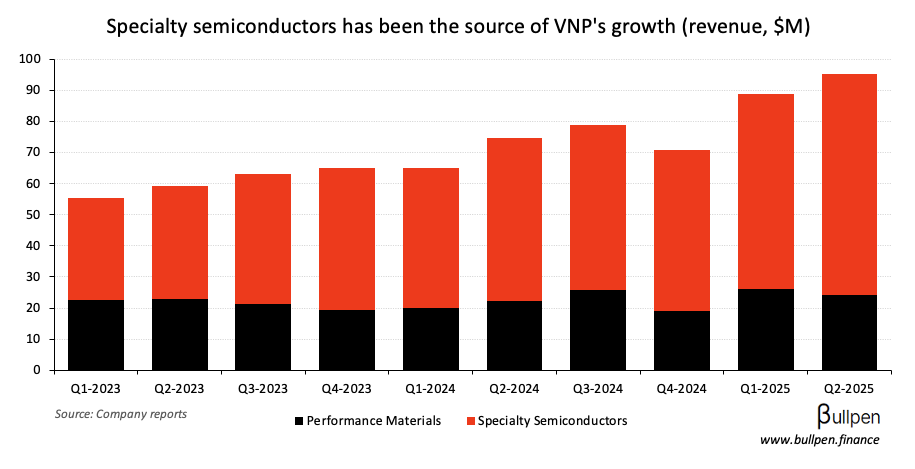

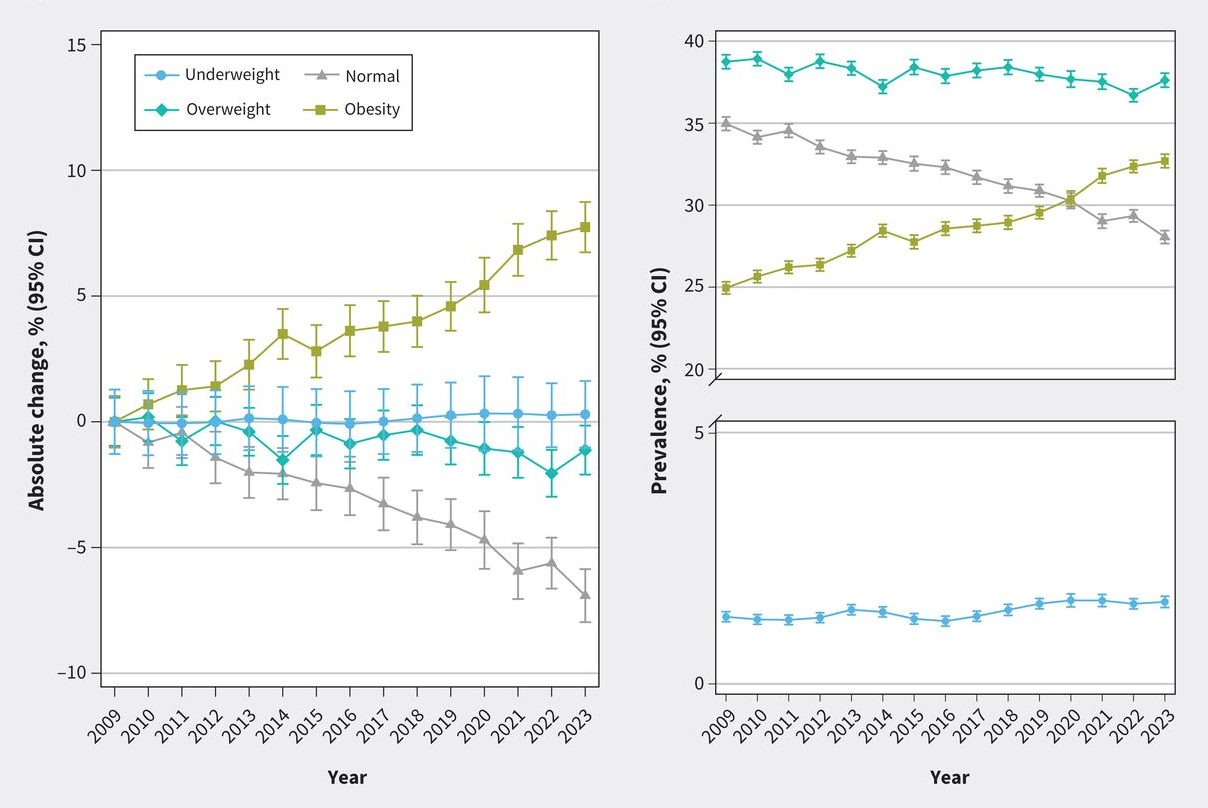

A common complaint from “Canadian capitalists” is that we need to be more like our American counterparts. Well, we got what we asked for but not what we wanted, with obesity on the rise in Canada according to a new study.

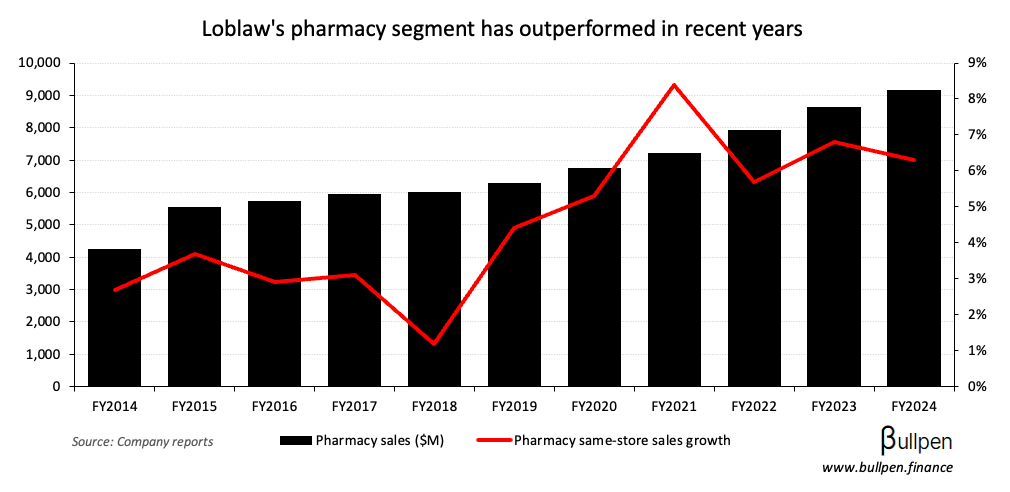

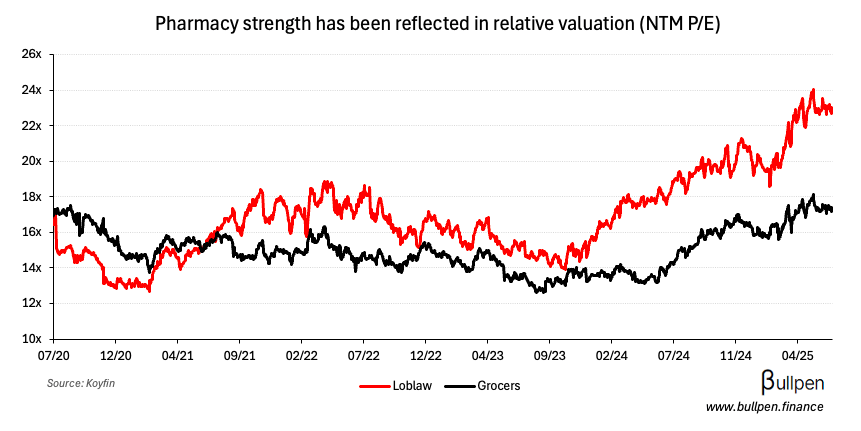

Just like our neighbours, we look for the easy way out - making the coming semaglutide (ozempic) patent expiry an interesting catalyst for Loblaw (L), as lower cost generics get the green light and the addressable market expands (both in size and waistline).

But Loblaw’s pharmacy segment (Shoppers Drug Mart) has been crushing it for some time, with same-store sales growth tracking well ahead of the traditional grocer business, resulting in a fat premium to peers… it’s probably priced in.

Sidebar: I’ve been thinking about getting a group together for the occasional fitness class (F45, Barry’s, spin, etc.)… if you’re interested and in Toronto, respond to this email below and we’ll see how numbers look (can bring whoever you want).

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Siren Fisekci | Pan American (PAAS) | $196K |

| Stephen Hodgson | Northern Dynasty (NDM) | $905K |

| Luis Castro | Endeavour (EDR) | $889K |

| Jennifer Trevitt | Avino (ASM) | $189K |

| Connie De Ciancio | Strathcona (SCR) | $140K |

| Brent Todd | A&W Food (AW) | $365K |

Flagging the Strathcona (SCR) buy, which comes at all-time highs and in the middle of its ongoing bid for MEG Energy… and the A&W (AW) buy, because it’s funny after that obesity news.

ON OUR RADAR

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

Intermap (IMP) jumped 24% yesterday after Stifel launched coverage with a $5/sh target price. With a new sales desk out there marketing the company as a defense play (sexy right now), let’s see if it keeps running and does a deal at some point.

Brookfield Renewable (BEP-U) was up 6% following its announced 3 GW hydro framework agreement with Google, starting with a 20-year, >$3B deal for power at two facilities. With BEP’s huge hydro footprint, there’s more where that came from.

Like its 10 GW agreement with Microsoft, this press run is more bark than bite. But a 20-year deal will allow it to finance the assets and re-deploy that cash into growth, extending Brookfield’s core advantage: scale and access to capital.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Cogeco (CGO) | 2.40 | 2.18 |

| 🇨🇦 Cogeco Comm. (CCA) | 1.82 | 1.95 |

| 🇨🇦 TRX Gold (TNX) | 3.6M | 10.3M |

| 🇺🇸 JPMorgan (JPM) | 4.96 | 4.48 |

| 🇺🇸 BlackRock (BLK) | 12.1 | 10.8 |

| 🇺🇸 Citigroup (C) | 1.99 | 1.60 |

| 🇺🇸 Wells Fargo (WFC) | 1.54 | 1.40 |

| 🇺🇸 Bank of NY (BK) | 1.94 | 1.76 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 J&J (JNJ) | AM | 2.68 |

| 🇺🇸 Bank of America (BAC) | AM | 0.86 |

| 🇺🇸 Morgan Stanley (MS) | AM | 1.98 |

| 🇺🇸 Goldman Sachs (GS) | AM | 9.62 |

| 🇺🇸 ProLogis (PLD) | AM | 0.73 |

| 🇺🇸 PNC (PNC) | AM | 3.56 |

| 🇺🇸 Kinder Morgan (KMI) | PM | 0.28 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Inflation Y/Y | 1.9% | 1.9% |

| 🇨🇦 Core Inflation Y/Y | 2.7% | - |

| 🇨🇦 Mftg. Sales M/M | -0.9% | -1.3% |

| 🇨🇦 New vehicle Sales | 194.5K | - |

| 🇺🇸 Inflation Y/Y | 2.7% | 2.7% |

| 🇺🇸 Core Inflation Y/Y | 2.9% | 3.0% |

| 🇺🇸 NY Mftg. Index | 5.5 | -9.0 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 8:15AM | 259K |

| 🇺🇸 PPI M/M | 8:30AM | 0.2% |

| 🇺🇸 Industrial Prod. M/M | 9:15AM | 0.1% |

| 🇺🇸 Mftg. Prod. M/M | 9:15AM | 0.0% |

| 🇺🇸 Capacity Utilization | 9:15AM | 77.4% |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: