The napkin math behind AutoCanada's 15% jump

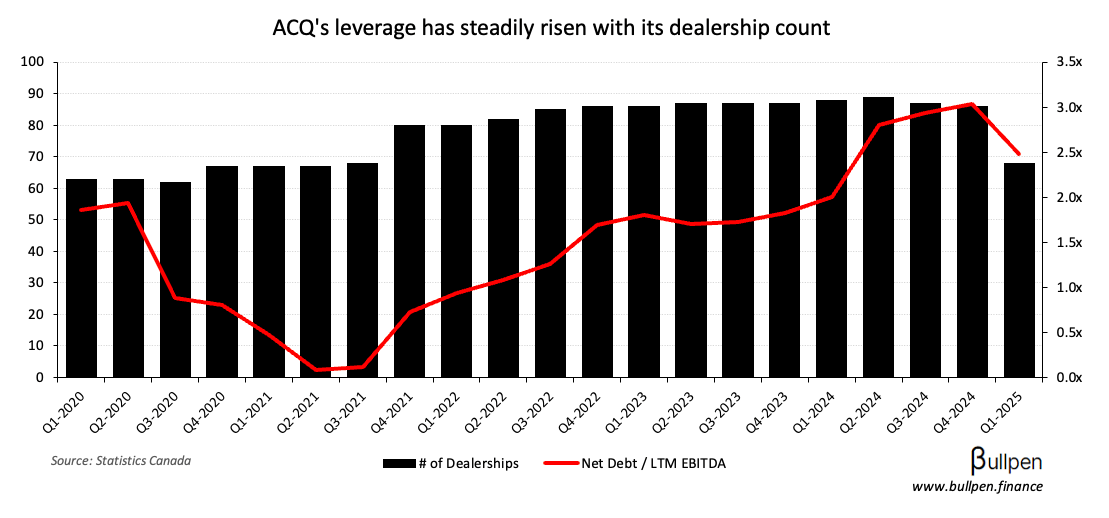

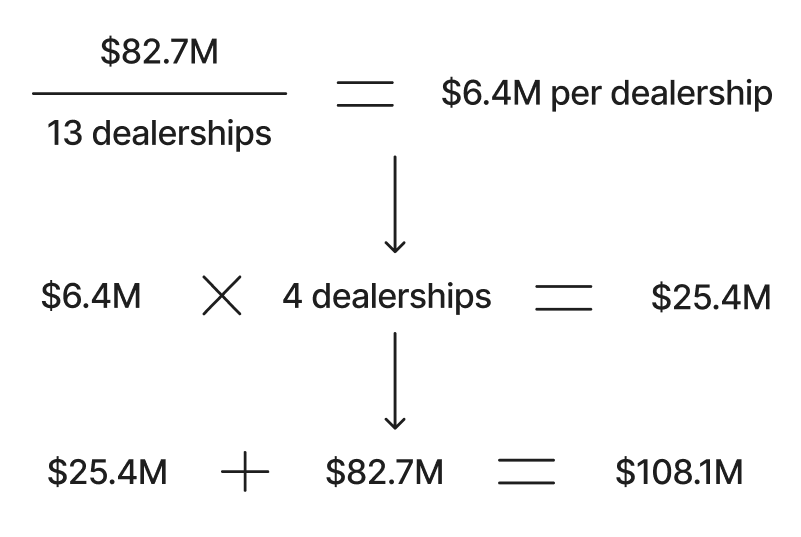

AutoCanada (ACQ) was up 15% after announcing the sale of most of its U.S. dealership footprint for $83M - a move that management said would result in a step-change improvement in the leverage profile.

So why did the market love it so much? The sale was for 13 dealerships and there’s 4 left to go. Should they be able to fetch the same price that’s another $25M, or roughly $110M in total.

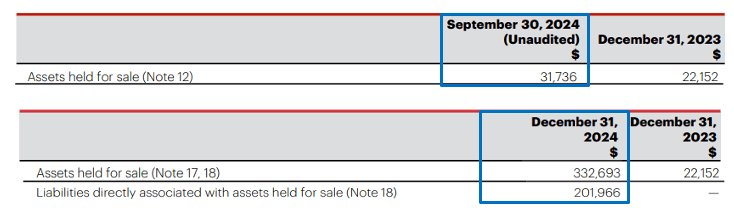

ACQ moved the U.S. segment into discontinued operations at the end of 2024. On the Q4 balance sheet, assets held for sale jumped $300M and liabilities held for sale jumped $200M, meaning the carrying value is around $100M.

So the deal gives the market certainty there won’t be any big writedown, and instead reframes the situation as a potential gain on sale… voila!

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

You might be interested in...

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 500+ professionals from: