Brookfield's billion dollar bet, graphite tariffs fuel >10% run

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

Brookfield’s billion dollar bet

NDM insiders sell before 50% drop

Graphene producers run on new tariff

Quiet weekend, so I decided to avoid coverage of useless headlines and instead go deeper on the one that matters. Let me know what you think of the format.

HOT OFF THE PRESS

Brookfield’s billion dollar bet and strategy

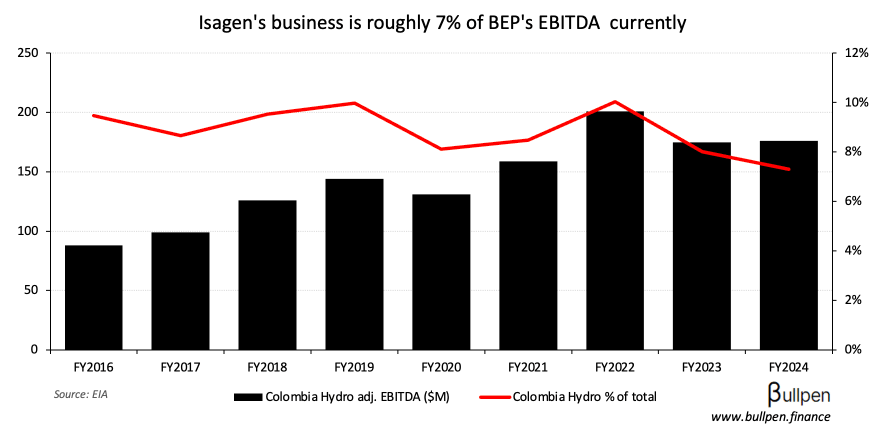

After the close on Friday Brookfield Renewable (BEP) announced it would invest up to $1B more in Isagen (Colombian hydro business) - taking its ownership stake close to 40%.

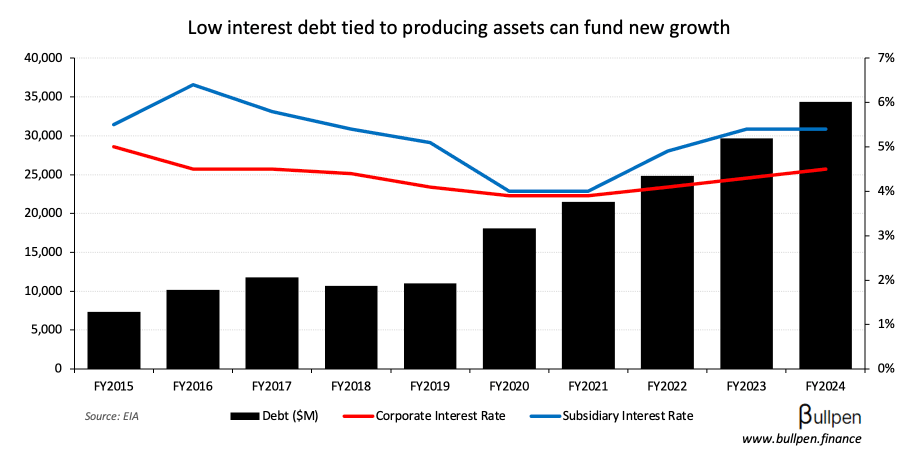

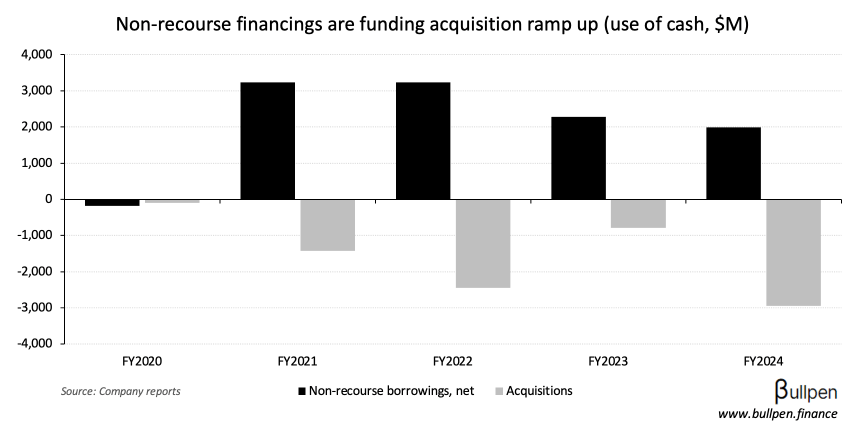

BEP said the deal would add roughly 2% to FFO/unit in 2026 and will be financed by non-recourse debt and available liquidity, bringing us back to the real benefit of its 3 GW hydro deal with Google. Read CEO Connor Teskey’s framing of the strategy:

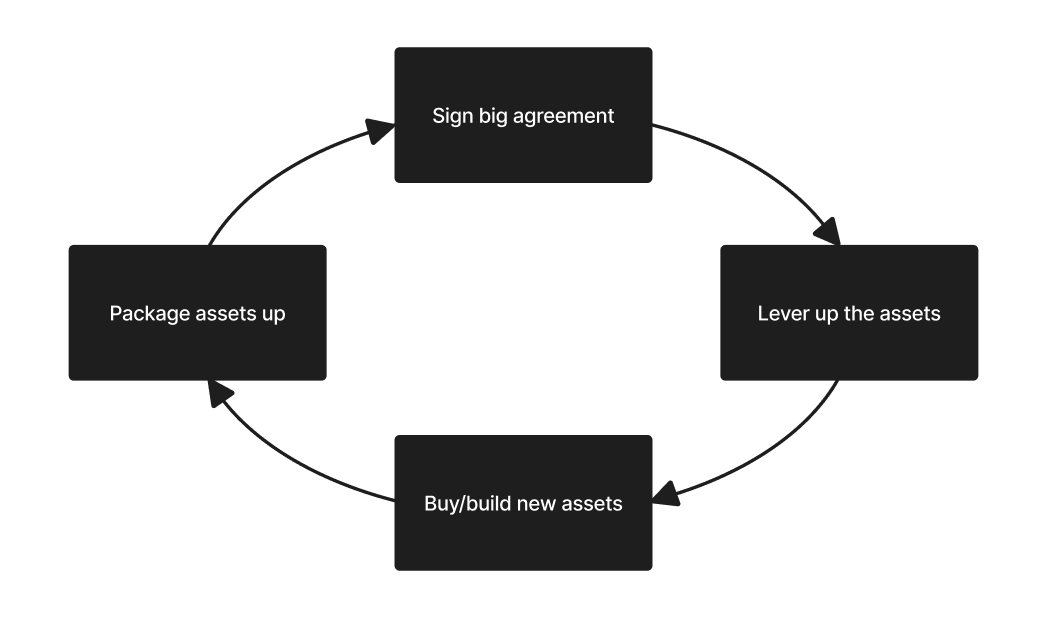

But really where it becomes incredibly accretive is if you lock in a long-term contract at a higher rate, it immediately creates some very low-cost up-financing opportunity for our business and provides a very large injection of capital at attractive rates, let’s say, give or take, 5%, that we can turn around and deploy into new growth and new M&A at 15%.

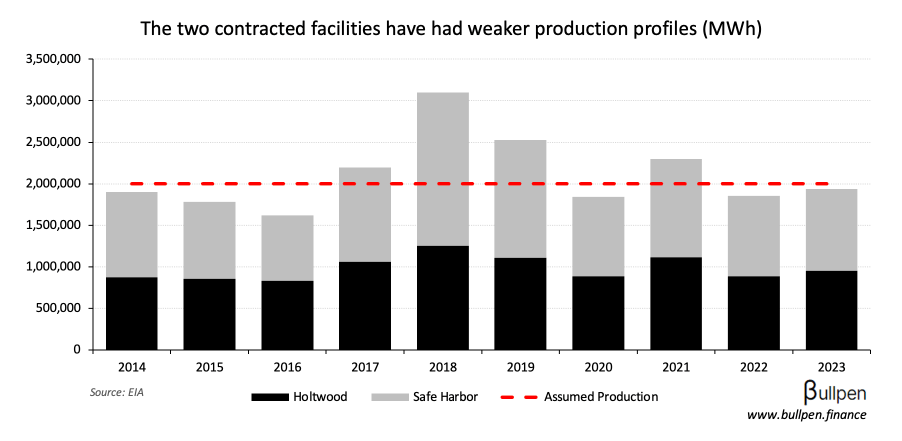

Let’s walk through this Google announcement to hammer the point home. Included in the initial deal were the Holtwood and Safe Harbor assets (670 MW), which are producing roughly two million megawatt hours per year.

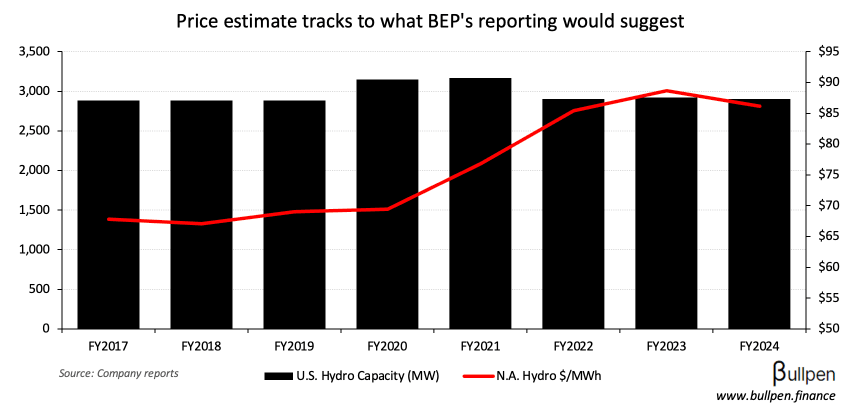

So on a deal the company said is worth in excess of $3B, Brookfield has locked in pricing at $85-90/MWh for two decades. That tracks to reported figures from the company…

… and recent management commentary.

This quarter, we successfully executed 2 contracts with U.S. utilities at an average price of almost $90 per megawatt hour for an average duration of almost 15 years.

There’s a financial uplift from signing those deals, but the real juice lies in what comes after. You just signed a predictable 20-year cash flow stream with Google as your counterparty… banks are begging you to take their money.

So you slap some debt on the asset package and take the proceeds to go big game hunting in order to fill out your 5-year, $8-9B capital deployment target.

It’s a feedback loop: the more agreements you sign, the more debt you can layer on your assets, the more buying/building you can do, the more agreements you can sign…

… and with big tech’s current appetite for power, the market believes the underlying math. Whether it should is up for debate, and a topic I’ll dig into in the future.

FUNNY BUSINESS

Well, didn’t take long for my tin foil theory on Astronomer’s viral marketing strategy to get proven wrong:

Unless…

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Douglas Nathanson | Empire (EMP-A) | $175K |

| Lee Curran | Peyto (PEY) | $439K |

| Barry Girling | Santacruz (SCZ) | $208K |

| Ronald Thiessen | Northern Dynasty (NDM) | $1.8M |

Flagging the Northern Dynasty (NDM) sale here, which is part of an aggregate ~$6M of selling by insiders before the company announced it hasn’t reached a settlement with the EPA over its Pebble mine in Alaska - sending the stock down >50%.

ON OUR RADAR

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

Canadian graphene producers ran hot after the U.S. announced a 93.5% tariff on Chinese graphite imports to curb anti-competitive dumping.

Given China’s dominance in natural graphite production…

… and its influence on artificial graphite supply, the import tax should take some margin pressure off of Canadian producers, who rely heavily on the U.S. export market.

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 Truist (TFC) | 0.91 | 0.93 |

| 🇺🇸 American Express (AXP) | 4.08 | 3.88 |

| 🇺🇸 Charles Schwab (SCHW) | 1.14 | 1.10 |

| 🇺🇸 3M (MMM) | 2.16 | 2.01 |

| 🇺🇸 Schlumberger (SLB) | 0.74 | 0.73 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 Verizon (VZ) | AM | 1.19 |

| 🇺🇸 Roper (ROP) | AM | 4.83 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Housing Starts | 1.32M | 1.30M |

| 🇺🇸 Building Permits Prel. | 1.40M | 1.39M |

| 🇺🇸 Consumer Sentiment | 61.8 | 61.5 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 PPI M/M | 8:30AM | 0.3% |

| 🇨🇦 Raw Materials M/M | 8:30AM | -0.2% |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: