PPI comes in hot, Chartwell adds another $430M acquisition

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

PPI hot, input costs could reverse

Chartwell’s latest $430M deal

Enbridge to build $900M solar farm

Meme stocks are back

PMET has world’s #1 caesium deposit

CNR lowers guidance on tariffs

HOT OFF THE PRESS

PPI comes in hot, input costs could reverse

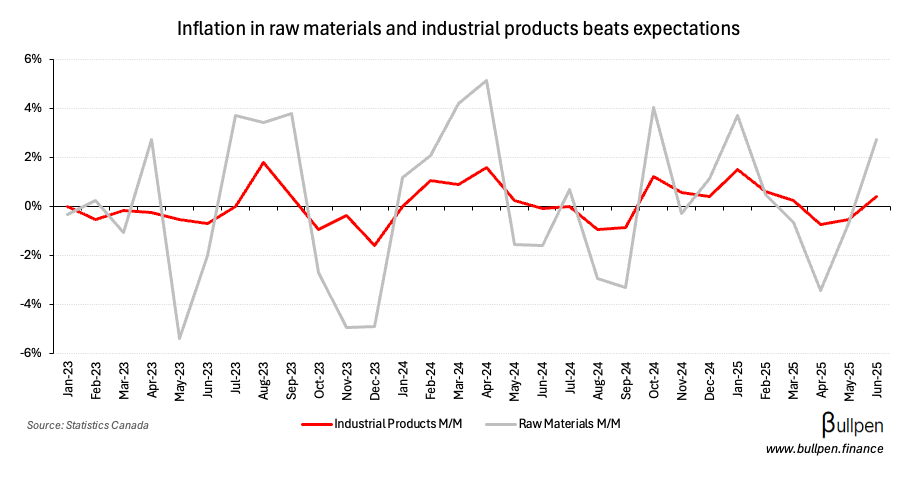

Industrial product prices rose 0.4% in June thanks to higher metals prices, topping estimates for a 0.1% gain and rebounding after two straight M/M declines.

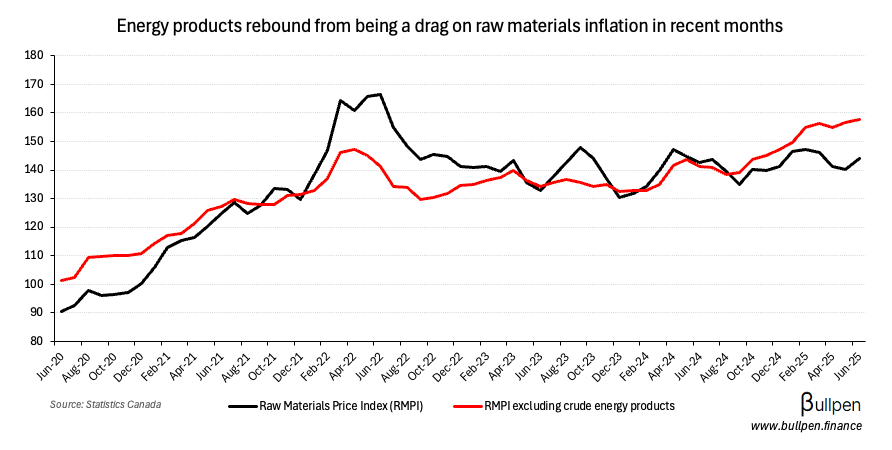

Input costs were higher too, rising 2.7% versus expectations for a 0.1% decline - which would have been the fourth straight had it materialized. As highlighted previously, the jump was led by a recovery in crude oil (+8%)…

… which accounted for most of the gain (+0.8% M/M excluding energy products). With oil prices returning below $70/barrel in July, the category should weigh on input costs in the next print.

Chartwell is back with a $430M deal

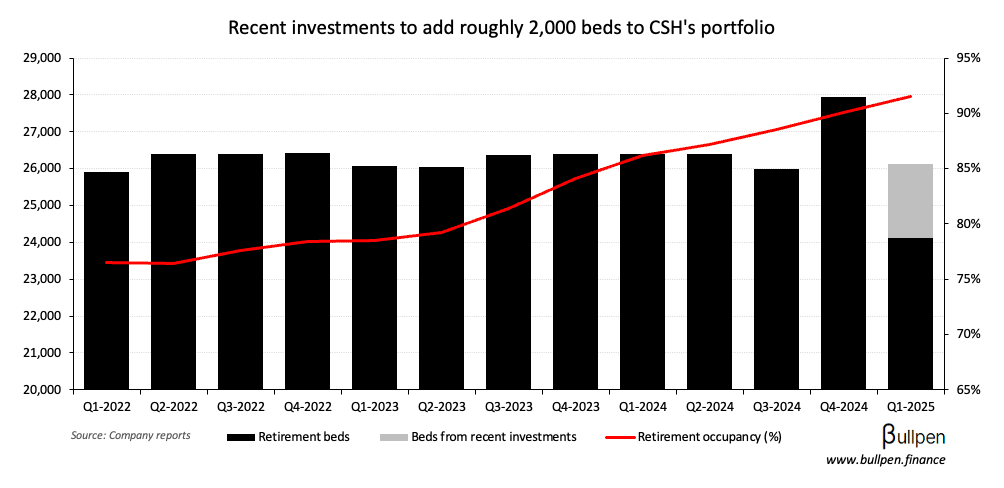

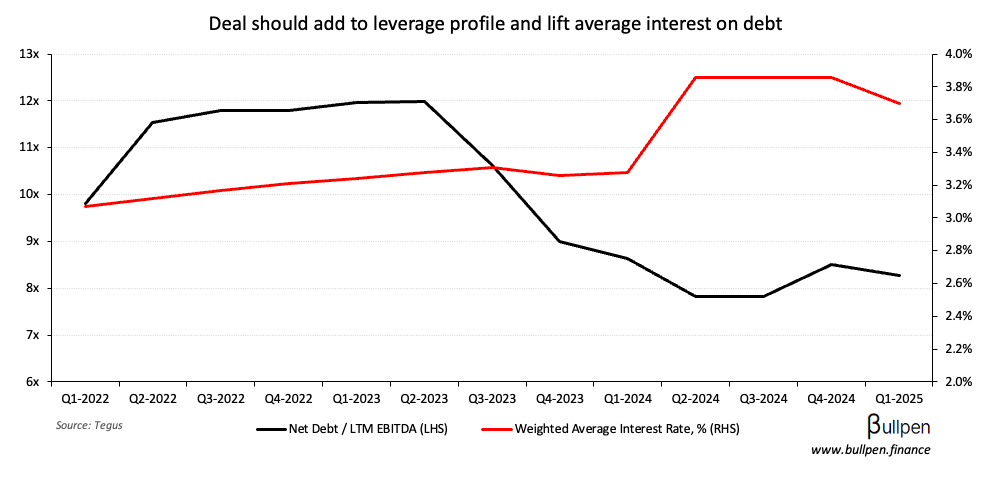

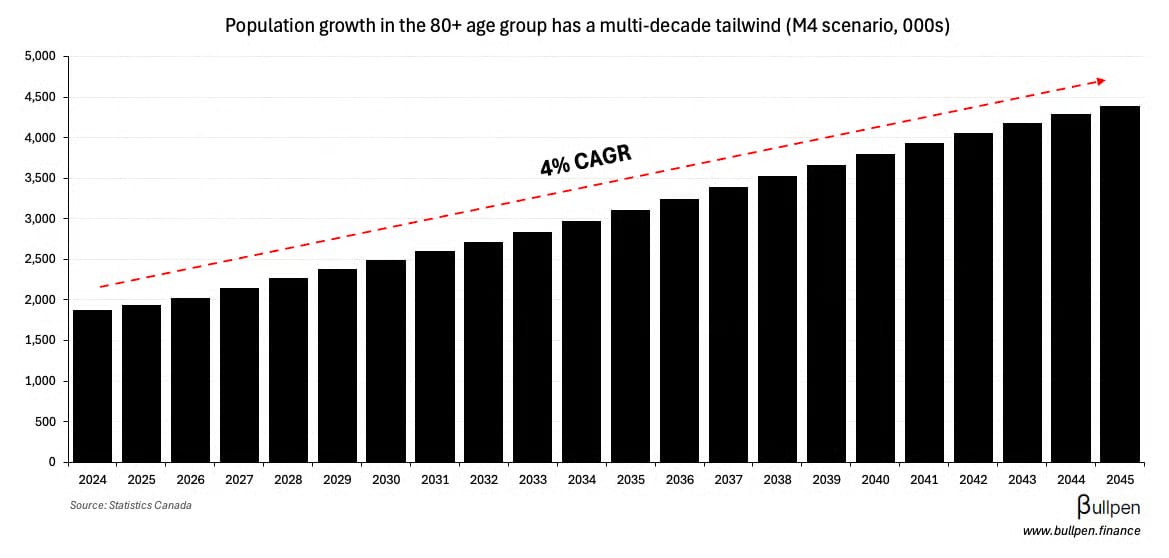

Chartwell Retirement (CSH) is back with a $430M deal for just over 1K suites, this time across Ontario - adding more than 8% to bed count when combined with its $290M, ~1K suite expansion in Quebec announced just over a week ago.

The deal includes excess land at one of the sites that acts as a lever for organic development (up to 140 suites). It’s financed partly by $230M of assumed debt (4.5%, 20-year term) with the remainder handled by already planned CMHC financings.

With $450M of available liquidity, favourable age demographics, and a management team with their foot on the gas - it’s unlikely this deal will be their last this year.

We hope to continue this momentum throughout 2025, with more exciting strategic acquisitions being evaluated and at various stages of negotiation.

Enbridge to build 600 MW solar farm for Meta

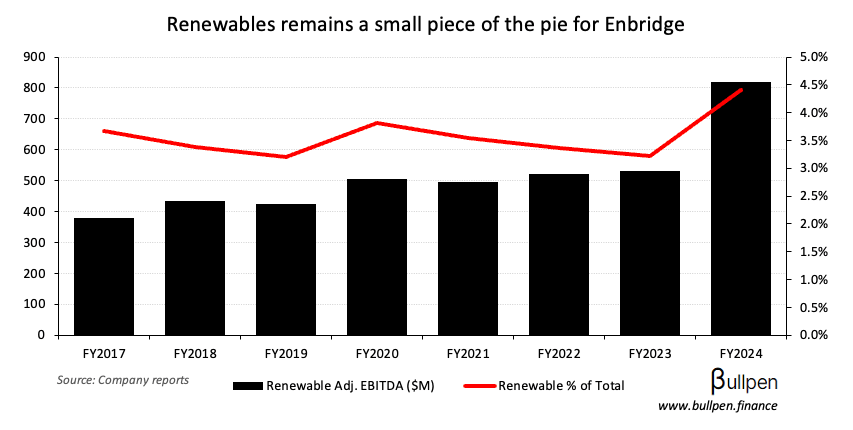

Enbridge is continuing to invest in solar power, moving forward with a $900M, 600 MW project in Texas set to be operational in 2027. All of the power will be contracted out to Meta…

… in yet another example that big tech is hungry for power (see Brookfield piece if you missed it). While the renewables segment accounts for less than 5% of EBITDA today…

… it represents nearly 15% of the company’s $50B development pipeline, as Enbridge transitions its business alongside global energy markets.

FUNNY BUSINESS

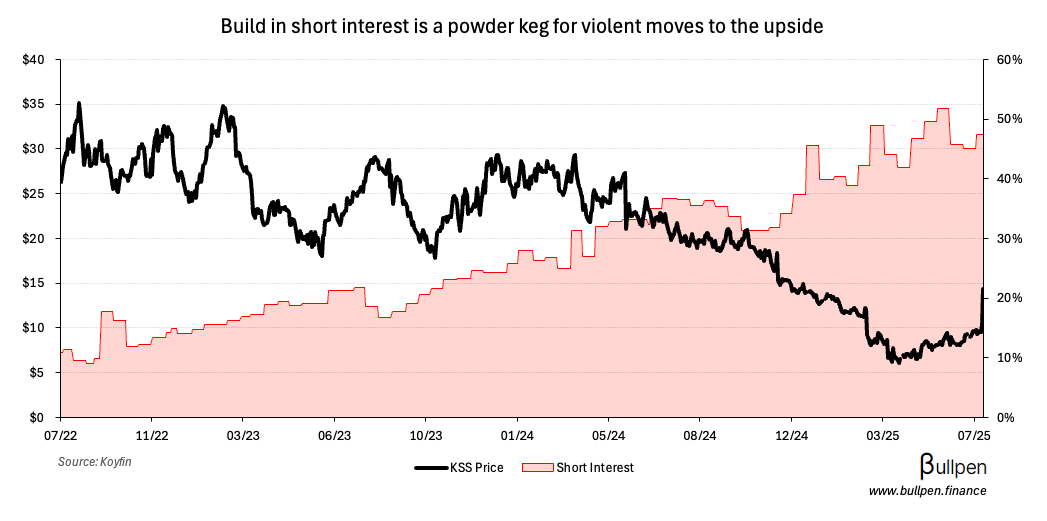

Meme stocks are back, with crowded shorts getting blown up one after another - Kohl’s being the latest, jumping as high as 70% yesterday before giving some back.

It’s unlikely to be the last big move, as volatility begets volatility - institutional money is going to be scrubbing their short books looking for potential land mines…

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Jennifer Wong | Aritzia (ATZ) | $4.5M |

| Todd Ingledew | Aritzia (ATZ) | $1.0M |

| Karen Kwan | Aritzia (ATZ) | $225K |

| Chris Vollmershausen | Agnico (AEM) | $475K |

| Jorge Durant | Fortuna (FVI) | $1.5M |

| Joel Holliday | Barrick (ABX) | $304K |

Flagging the insider selling at Aritzia (ATZ), which has hit over $55M YTD with these latest transactions.

ON OUR RADAR

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

Patriot Battery Metals (PMET) was up 9%, extending its run after a 24% gain on Monday when the company announced what could be the world’s largest caesium deposit - an extremely rare metal that’s used in applications like medical imaging and solar panels.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Pulse Seismic (PSD) | 0.19 | - |

| 🇨🇦 Cdn. National (CNR) | 1.87 | 1.87 |

| 🇺🇸 Coca-Cola (KO) | 0.87 | 0.84 |

| 🇺🇸 Philip Morris (PM) | 1.91 | 1.86 |

| 🇺🇸 Raytheon (RTX) | 1.56 | 1.43 |

| 🇺🇸 Lockheed Martin (LMT) | 7.29 | 6.47 |

| 🇺🇸 DR Horton (DHI) | 3.36 | 2.90 |

Canadian National Railway (CNR) reported a small miss on the top line and in-line profit, but it’s likely the stock is going to trade down at the open. Tariffs are weighing on volume and the EPS guide, which moves down to 5-9% Y/Y growth from 10-15% previously.

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Rogers (RCI-B) | AM | 1.10 |

| 🇨🇦 Headwater (HWX) | PM | 0.17 |

| 🇨🇦 First Quantum (FM) | PM | -0.05 |

| 🇨🇦 Whitecap (WCP) | PM | 667M |

| 🇨🇦 West Fraser (WFG) | PM | 0.17 |

| 🇺🇸 Alphabet (GOOG) | PM | 2.20 |

| 🇺🇸 Tesla (TSLA) | PM | 0.40 |

| 🇺🇸 IBM (IBM) | PM | 2.65 |

| 🇺🇸 AT&T (T) | AM | 0.53 |

| 🇺🇸 Chipotle (CMG) | PM | 0.33 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Richmond Mftg. Index | -20 | -3 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 New Home Price Index | 8:30AM | 0.0% |

| 🇺🇸 Existing Home Sales | 10:00AM | 4.0M |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: