Trump ups Canada tariffs to 35%, job vacancies hit 8-year low

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

Trump ups Canada tariffs to 35%

GDP contracts for 2nd month straight

Job vacancies hit 8-year low

GFL jumps 6% on a beat and raise

Copper slides 20% on lighter tariff

HOT OFF THE PRESS

Trump ups broad-based tariffs to 35%

Alongside a set of additional tariffs imposed on countries the U.S. hasn’t yet struck a deal with, Canada’s blanket 25% tariff has been reset to 35% - further pressuring an already strained trade relationship.

Thankfully, the new measures still exclude USMCA-compliant goods. The trade agreement is the reason the tariff-fallout hasn’t been worse, and is an area Trump will keep applying pressure leading up to the 2026 review.

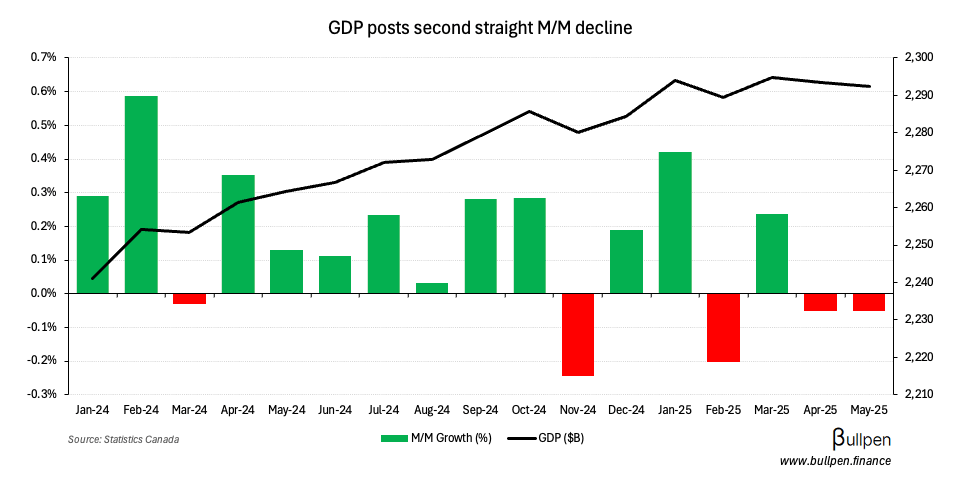

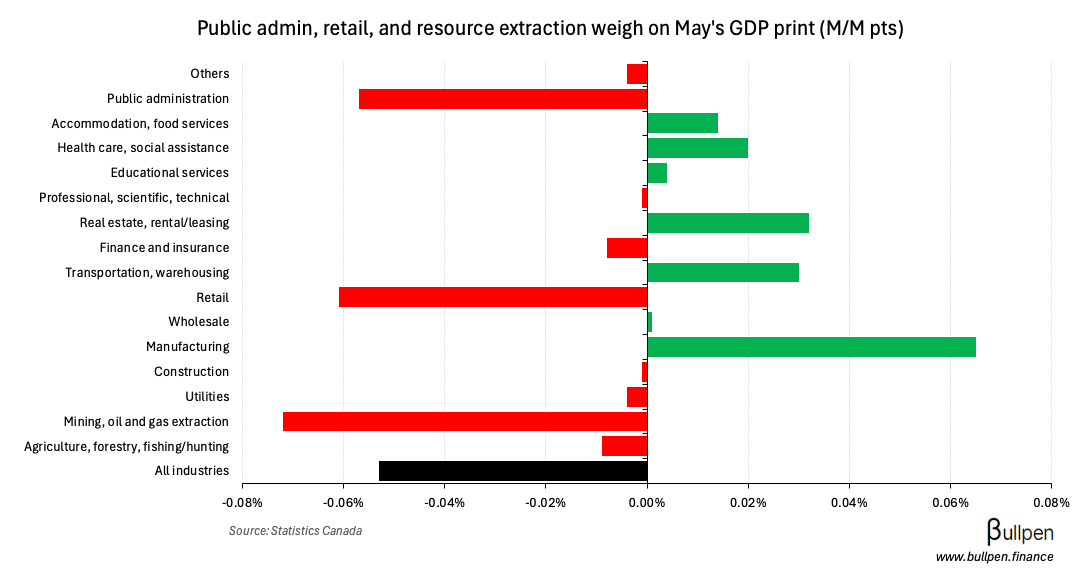

GDP contracts for second month straight

GDP fell 0.1% in May, in-line with analyst expectations for a second straight monthly contraction driven by weakness in goods-producing industries.

The slowdown was felt most in resource extraction, public administration, and retail trade - as refinery maintenance, a post-election air pocket, and auto tariffs all put pressure on results for the month.

The print wasn’t all bad though, with inventory builds supporting a manufacturing rebound…

… home resale activity driving the second straight gain in real estate…

… and a broad-based recovery in transportation. Combined with an expected uptick in retail sales, early estimates for June call for a 0.1% rebound in GDP.

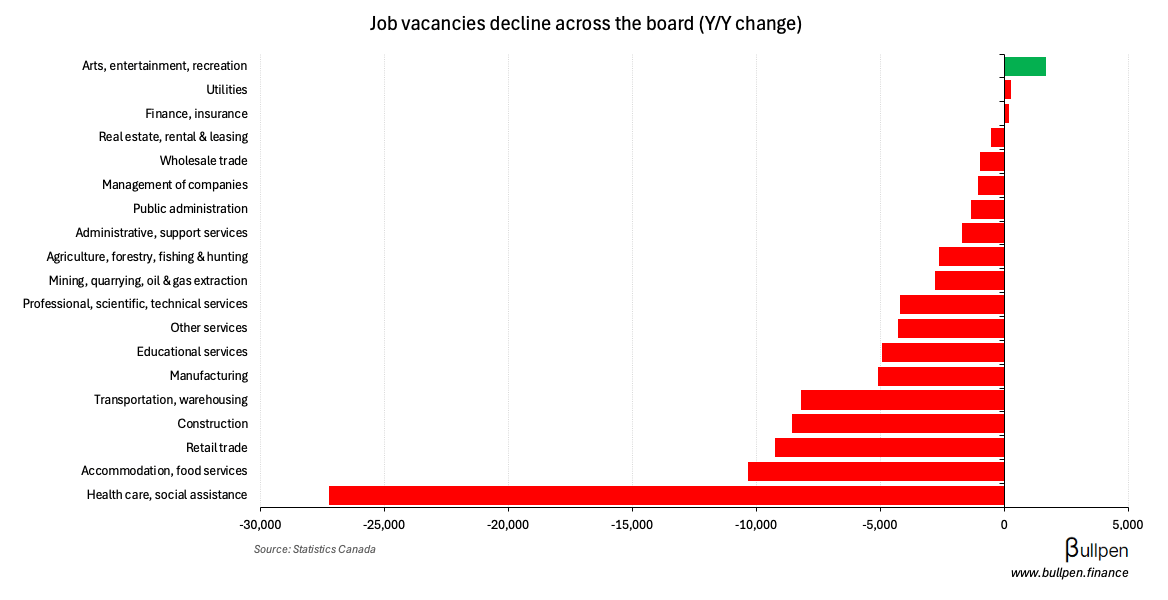

Job vacancies hit 8-year low

Payroll employment increased for a second straight month in May, gaining 0.1% thanks to adds in health care and retail trade, partly offset by continued weakness in manufacturing - where employment has declined 1.2% since December.

The real story in this release was job vacancies though, which fell another ~4% after April’s ~3% decline and sit nearly 16% lower than they were a year ago.

At ~480K, vacancies are at their lowest level in almost eight years while unemployment remains elevated, posing challenges for any near-term recovery in the labour market.

FUNNY BUSINESS

Earnings season is starting to ramp up…

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Murray Bye | Surge (SGY) | $335K |

| Sandra Sanderson | Empire (EMP-A) | $133K |

| Pippa Morgan | Aritzia (ATZ) | $142K |

ON OUR RADAR

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

GFL Environmental (GFL) was up 6% on earnings, which beat estimates on both revenue and profit thanks to pricing-led margin expansion and volume growth.

The strong print prompted management to take its full-year guide higher, adding $110M and $50M to the revenue and EBITDA outlook, respectively. With net leverage sitting at 3.2x…

… the always aggressive Patrick Dovigi has room for continued buybacks (3.5M shares in Q2) and M&A, which could be further fuelled by a partial sale of its infrastructure unit.

We’re looking to conclude that process over the next 2 to 3 weeks. I think we’re on the 5-yard line, we’re down to 2 final bidders…

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Bombardier (BBD) | 1.11 | 1.04 |

| 🇨🇦 Lightspeed (LSPD) | 0.06 | 0.13 |

| 🇨🇦 TC Energy (TRP) | 0.82 | 0.78 |

| 🇨🇦 Gildan (GIL) | 0.97 | 0.96 |

| 🇨🇦 Canada Goose (GOOS) | -0.91 | -0.87 |

| 🇨🇦 Brookfield Infra (BIP) | -0.03 | 0.31 |

| 🇨🇦 Spin Master (TOY) | -0.07 | 0.06 |

| 🇨🇦 Real Matters (REAL) | -0.01 | 0.01 |

| 🇨🇦 Polaris (PIF) | 15.4M | 15.2M |

| 🇨🇦 Kiwetinohk (KEC) | 1.39 | 0.44 |

| 🇨🇦 Colliers (CIGI) | 1.72 | 1.48 |

| 🇨🇦 Cenovus (CVE) | 0.34 | 0.11 |

| 🇨🇦 ATCO (ACO-X) | 0.90 | 0.89 |

| 🇨🇦 Coveo (CVO) | -1.9M | -1.3M |

| 🇨🇦 Capstone (CS) | 0.06 | 0.06 |

| 🇨🇦 Growth Int. (AFN) | 54.2M | 52.9M |

| 🇨🇦 TMX Group (X) | 0.52 | 0.51 |

| 🇨🇦 MEG Energy (MEG) | 0.26 | 0.05 |

| 🇨🇦 Fairfax (FFH) | 1.13B | 1.05B |

| 🇨🇦 NFI Group (NFI) | 0.09 | 0.08 |

| 🇨🇦 Aecon (ARE) | -0.09 | 0.04 |

| 🇨🇦 Dundee (DPM) | 0.49 | 0.47 |

| 🇨🇦 ARC Resources (ARC) | 0.68 | 0.58 |

| 🇨🇦 Baytex (BTE) | 0.20 | 0.03 |

| 🇨🇦 Definity (DFY) | 0.84 | 0.76 |

| 🇨🇦 Eldorado (ELD) | 0.68 | 0.49 |

| 🇨🇦 Ero Copper (ERO) | 0.64 | 0.46 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Magna (MG) | AM | 1.15 |

| 🇨🇦 Fortis (FTS) | AM | 0.70 |

| 🇨🇦 Brookfield Ren. (BEP) | AM | -0.48 |

| 🇨🇦 Enbridge (ENB) | AM | 0.57 |

| 🇨🇦 Telus Int. (TIXT) | AM | 0.06 |

| 🇨🇦 Imperial Oil (IMO) | AM | 1.61 |

| 🇨🇦 AltaGas (ALA) | AM | 0.23 |

| 🇨🇦 TransAlta (TA) | AM | 0.11 |

| 🇨🇦 Telus (T) | AM | 0.24 |

| 🇨🇦 Topicus (TOI) | PM | 0.46 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | -0.1% | -0.1% |

| 🇺🇸 Chicago PMI | 47.1 | 42.0 |

| 🇺🇸 Jobless Claims | 218K | 224K |

| 🇺🇸 Continuing Claims | 1,946K | 1,960K |

| 🇺🇸 Personal Income M/M | 0.3% | 0.2% |

| 🇺🇸 Personal Spending M/M | 0.3% | 0.4% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 S&P Mftg. PMI | 9:30AM | - |

| 🇺🇸 Non Farm Payrolls | 8:30AM | 110K |

| 🇺🇸 Unemployment Rate | 8:30AM | 4.2% |

| 🇺🇸 ISM Mftg. PMI | 10:00AM | 49.5 |

| 🇺🇸 Consumer Sentiment | 10:00AM | 62 |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Copper has shed over 20% in the past two days, following a dialled back version of Trump’s original 50% tariff on the red metal that largely spares Canadian exports.

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: