Activist investor calls out 200% upside at Cineplex

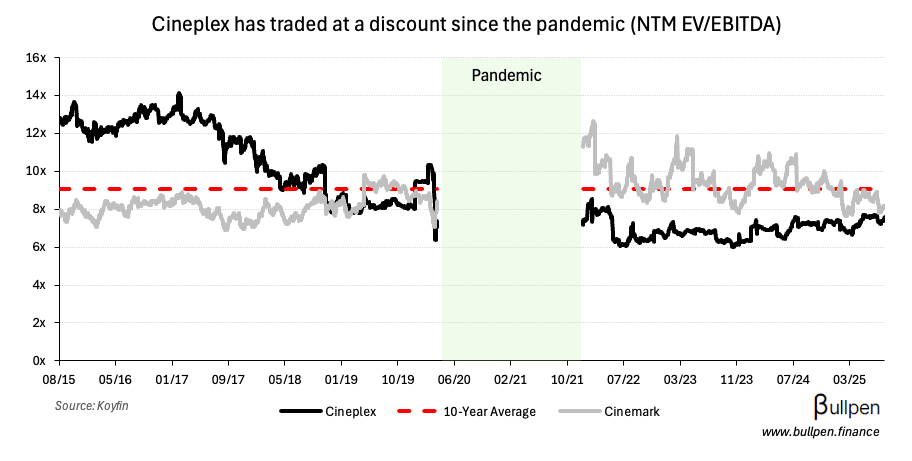

Windward Management is turning up the volume on its Cineplex (CGX) activist campaign, with the ~7% shareholder calling for 200% upside potential if management works to fix its discount…

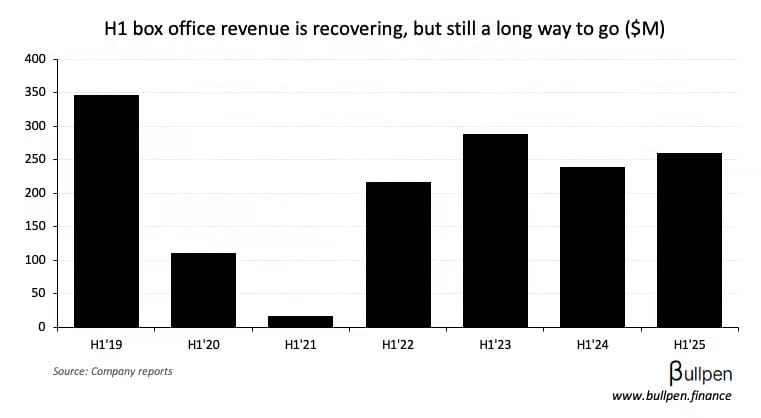

… by buying back stock hand over fist, before box office numbers fully recover. They’re looking for the company to repurchase over half of shares outstanding…

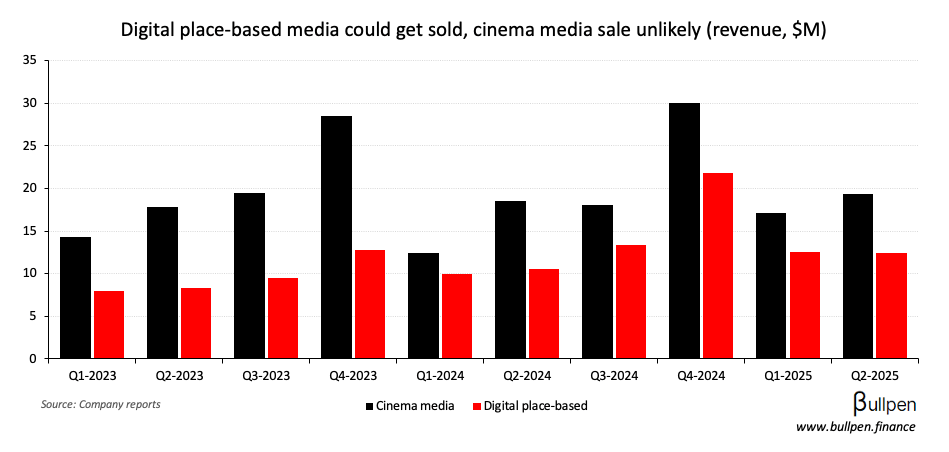

… supported by a $261M EBITDaL forecast and a potential digital media sale, which Windward predicts could fetch $100M - with the possibility for another $120M if CGX sells its remaining 33% stake in Scene+.

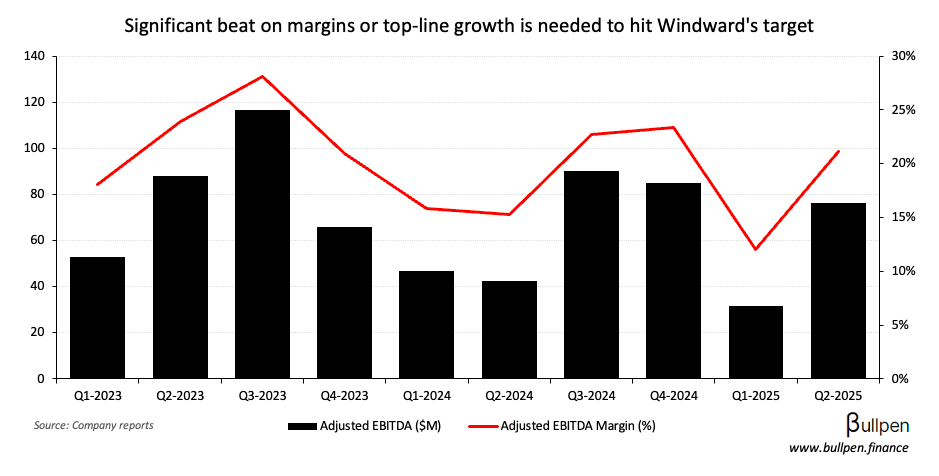

Sounds too good to be true and probably is, despite being directionally correct. For one, Windward’s 2026 EBITDAaL forecast sits >20% above the street - that’s a lot of margin expansion baked in.

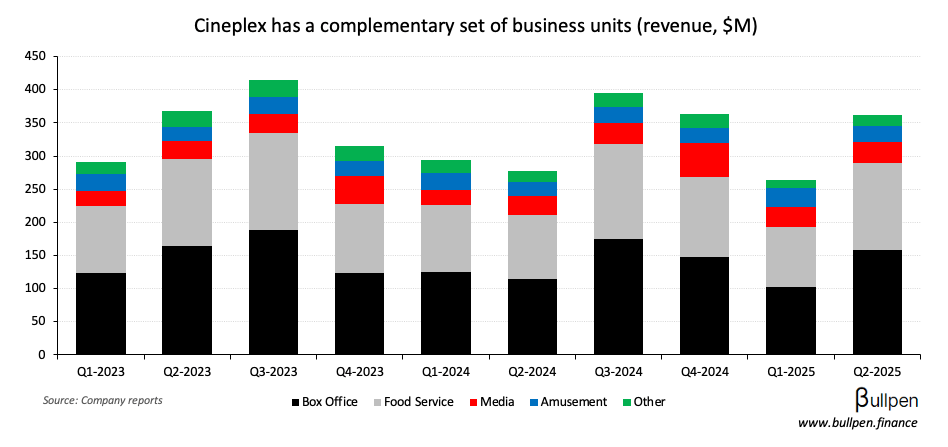

Management’s thinking on divestitures is also unclear, despite a partial sell-down of its stake in Scene+ and rumours of a media sale in the past. With CGX highlighting the complementary nature of each segment…

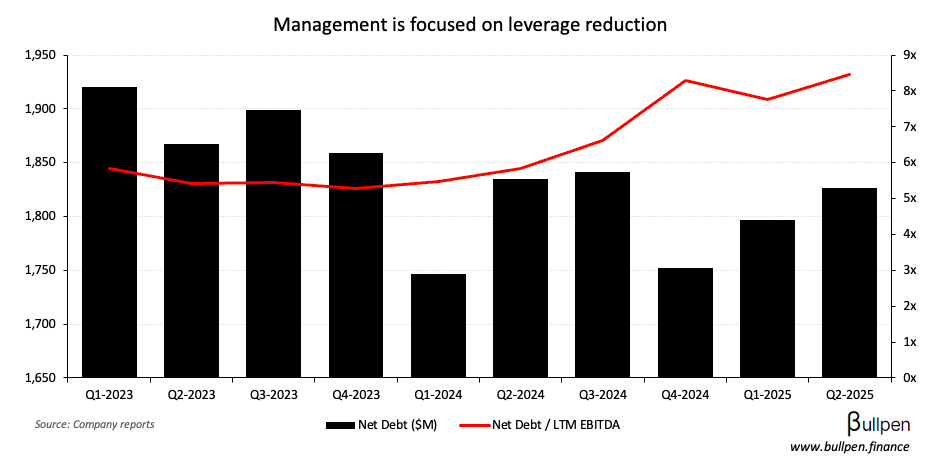

… and making no mention of asset monetization on recent calls, Windward’s H2’25 prediction is uncertain. What is certain is the contrast in operating style, with CGX management sticking to a more conservative, leverage-focused strategy…

… before ramping up a return of capital via buybacks and dividends.

One of those elements is to consider to get more active would be once we sort of hit that $50M cash balance and have the full draw on the operating facility, that would be a trigger.

At $42M in cash as of Q2 and a recent renewal of the NCIB, we’re likely to see some activity in what’s been a dormant buyback program soon - that could put a floor under shares… not a bad setup.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: