SHOP is expensive, but you get what you pay for

We decided to dig into Canada’s technology darling to see what’s been going on with the story, given the stock has been volatile over recent years.

Q1’23: Price hikes for core SHOP product

Q4’23: Weak FCF guidance

Q1’24: Regain rule of 40, committed to focus on FCF margin while balancing growth

Q1’25: Move to Nasdaq from NYSE

There’s a lot to catch up on here, as investors on either side of the trade have a case:

Bullish Points | Bear Points |

|---|---|

Strongest moat in e-commerce | Small business exposure |

Further connecting ecosystem of products, leveraging strong distribution | Competition from all directions |

Highest FCF conversion of peers | Software has a deteriorating moat |

International expansion opportunities (has been growing >30%) | Rich valuation is tough to swallow |

Fundamentals accelerating in multiple areas

SHOP continues to grow the volume of business conducted through its platform while expanding its share of total transaction value.

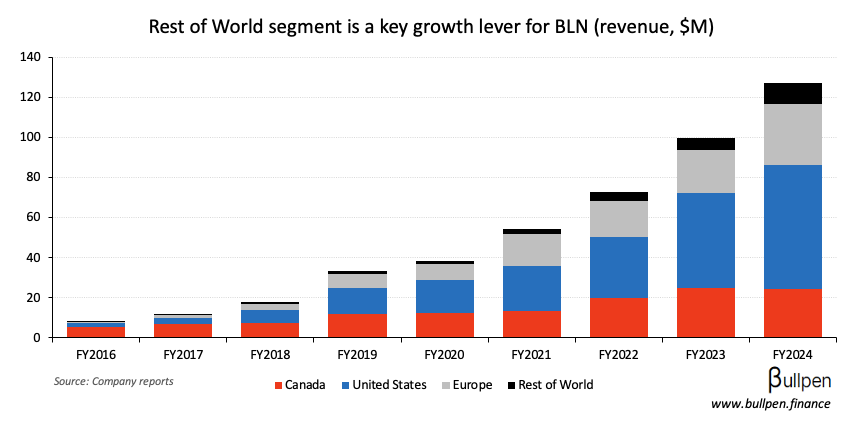

The growth has been broad-based, though Shopify’s international business has been expanding rapidly, given its immaturity in comparison to the North American business.

SHOP breaks its revenue down in two main segments:

Merchant Solutions (+33% Y/Y): from transaction fees and additional services like payments and analytics, varying with sales volume.

Subscription Solutions (+27% Y/Y): from monthly fees merchants pay for platform access, providing steady income.

Within its subscription segment, core revenue accounts for more than half of the total, though Shopify Plus revenue has been growing, as the company continues to penetrate the enterprise channel.

The expansion of this segment in conjunction with its rapid adoption of AI has helped the company convert its top-line growth into free cash flow more efficiently.

We'll continue to use AI and automation to internally to make Shopify even more effective and efficient. We are though, as you know this, you followed us for a while, we are a growth company and we will take the opportunities to invest today for future growth when the opportunities are there at a very high return.

SHOP has focused on turning on the FCF taps, and they’re flowing! In software, a common metric used is the rule of 40, a combination of top-line growth and bottom-line margins. A reading above 40 is viewed favourably, as it indicates a company is growing sustainably.

What should you be looking out for?

The obvious metrics to follow are GMV and FCF. Any deterioration in GMV would hurt the growth narrative, and pressure on FCF margins could signal to investors that SHOP won’t be able to maintain growth at current economics.

The bulls will say: SHOP’s ability to integrate new products into its ecosystem should drive higher take rates and additional sellers opting into its competitive offering.

A great example is SHOP’s payments business, which has been adopted by nearly 65% of its customer base, up from just over 50% a few years ago!

The bears will say: growth in the merchant and subscription segments have shown signs of margin compression in recent quarters, indicating competition is heating up.

While some of this is surely attributable to competition, new customers naturally come in at lower margins as the full SHOP product suite isn’t adopted right away. A couple of quarters doesn’t make a trend, but we’d be watching this closely.

SHOP could look to lift subscription pricing if it faces persistent margin compression, which it hasn’t done in two years on its core plan (Q1’23) and over a year on its plus plan (Q4’23). Given economic uncertainty the window to do this might be closed for now, but what do we know - we didn’t build Shopify!

Here were the key themes from analyst questions over the last two years:

Growth sustainability: How sustainable is Shopify's 25%+ revenue growth in an increasingly competitive landscape?

Enterprise customer acquisition: Can Shopify continue to attract larger merchants and what features (particularly checkout functionality) are driving this migration?

Payments penetration: There’s been a continued focus on the growth of Shopify Payments and Shop Pay, and on the strategies being used to increase adoption in international markets.

Valuation is rich, but can be justified

Given SHOP’s leadership position in the industry, it has historically traded at significant premium to peers when looking at EV/sales - a common valuation metric for high growth software.

However, not all software companies are created equal. SHOP’s ability to grow fast and profitably is where much of the premium comes from - with many enterprise SaaS peers with similar rule of 40 profiles trading around SHOP’s multiple.

Bottom line, SHOP is a generational company with multi-decade long tailwinds, but there could be near-term volatility. We’d be owners of the business over the long-term while being diligent on competitive dynamics, but would be cautious on taking a short-term position as the rotation out of technology could still have more room to play out.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: