Air Canada facing turbulence: will tariffs make the snowbird extinct?

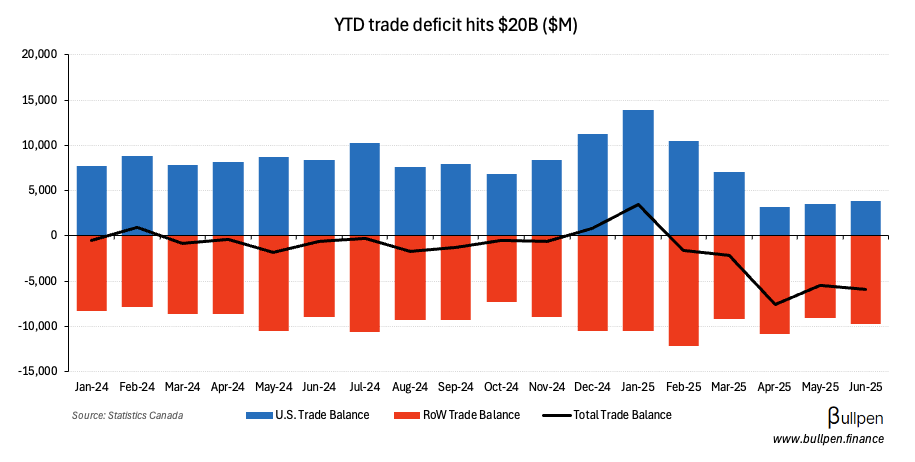

Unfortunately for Air Canada (AC) a perfect storm has been brewing, with the “Buy Canada” movement, a weak loonie, and tempered economic forecasts all contributing to a 40% YTD decline.

An alarming report came out last month saying booking demand is down as much as 70% through September, but management sees something much more modest.

By mid-March, the bookings on the transborder market overall for the next 6 months, we're down about 10% year-on-year according to our data, and our own numbers were of comparable magnitude.

We got commentary more recently from Delta, who seems to be seeing a more aggressive demand drop off.

Yes. In Canada, we have seen a significant drop-off in bookings

While a deterioration of U.S. transborder demand would hurt, the segment represents roughly 20% of AC’s total passenger revenue…

… and has lower load factors than every other route segment Air Canada services.

Weak U.S. travel demand could have a silver lining for AC too, as competing U.S. airlines look to reduce exposure.

I think we will be looking at Canada and Mexico as places that we probably want to reduce our capacity levels as we move forward.

Bottom line: It’s been a challenging setup for AC of late with a weak Canadian economy and tariff concerns. The sentiment remains highly bearish, but it has shown torque to economic turnarounds in the past so it’s worth keeping an eye on.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: