Bank earnings start strong, 200% upside at Cineplex?

|

| ||||

|

| ||||

|

| ||||

|

|

WHAT'S ON TAP

Cineplex activist sees 200% upside

The Taylor Swift trade is on

Banks rally on strong start to Q3

MDA’s latest deal could get upsized

HOT OFF THE PRESS

Does Cineplex really have 200% upside?

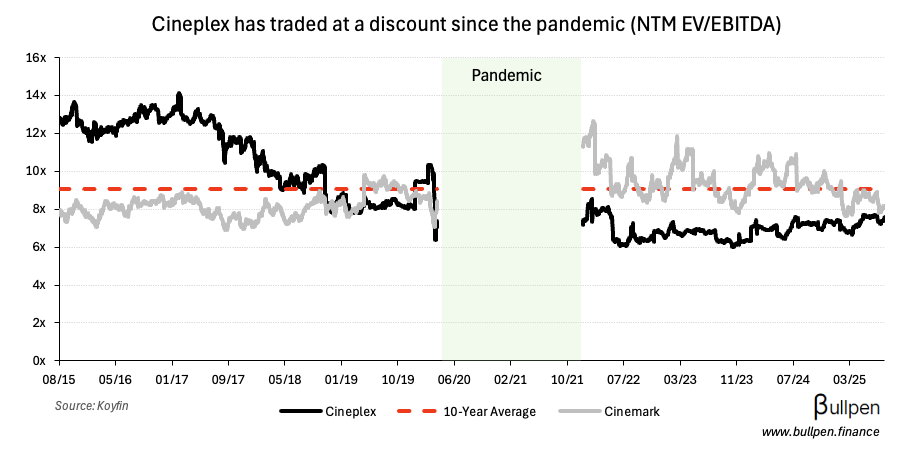

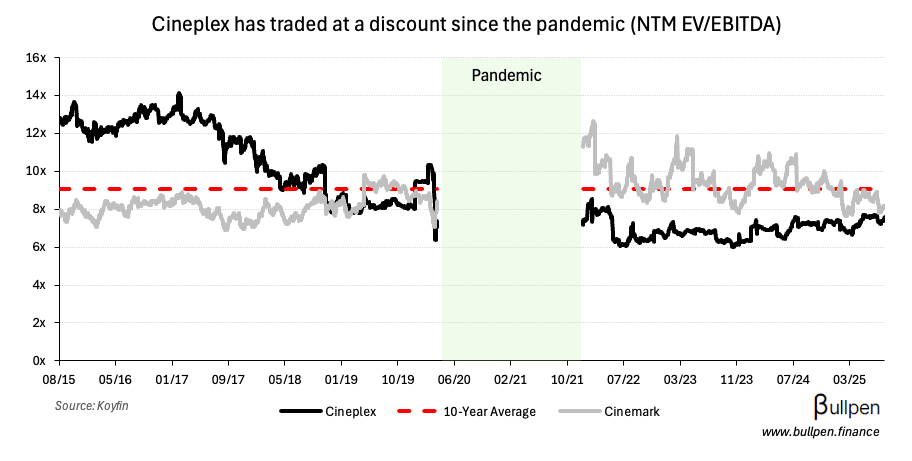

Windward Management is turning up the volume on its Cineplex (CGX) activist campaign, with the ~7% shareholder calling for 200% upside potential if management works to fix its discount…

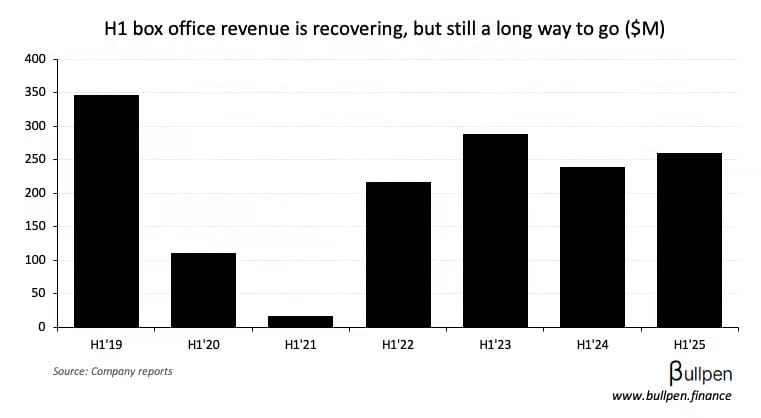

… by buying back stock hand over fist, before box office numbers fully recover. They’re looking for the company to repurchase over half of shares outstanding…

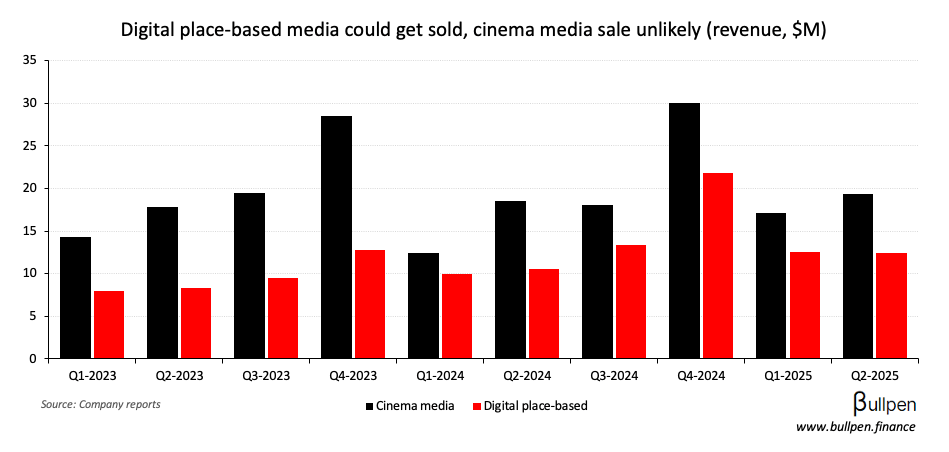

… supported by a $261M EBITDaL forecast and a potential digital media sale, which Windward predicts could fetch $100M - with the possibility for another $120M if CGX sells its remaining 33% stake in Scene+.

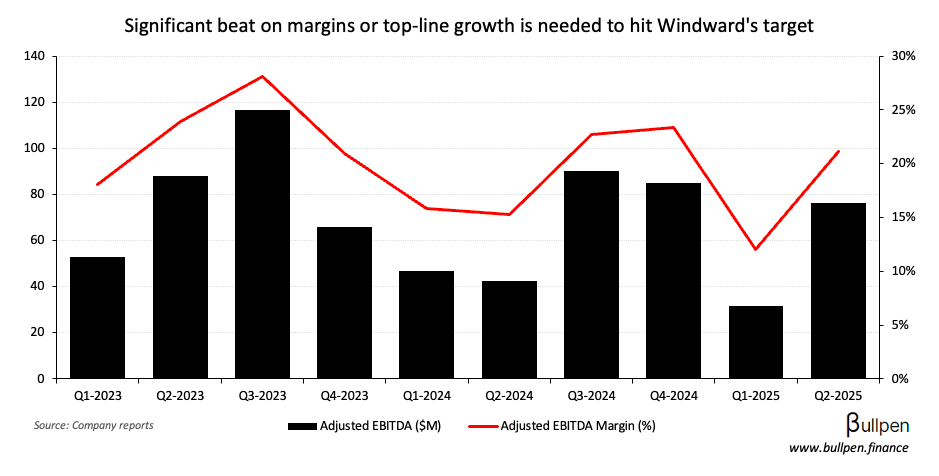

Sounds too good to be true and probably is, despite being directionally correct. For one, Windward’s 2026 EBITDAaL forecast sits >20% above the street - that’s a lot of margin expansion baked in.

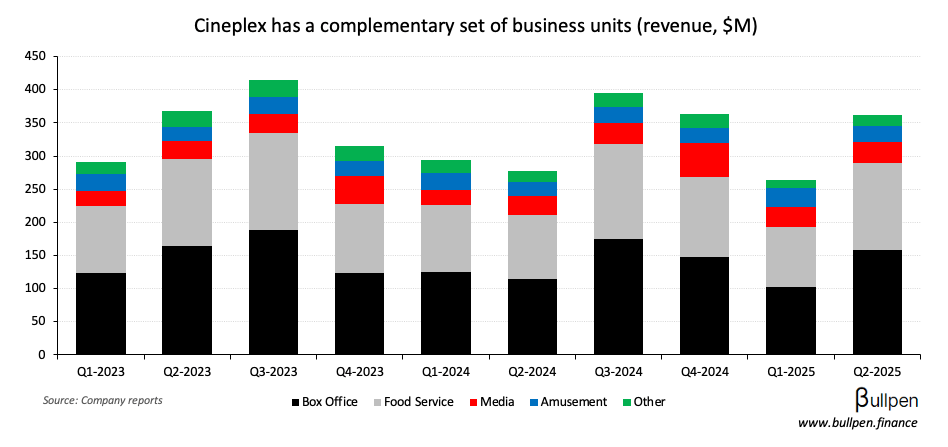

Management’s thinking on divestitures is also unclear, despite a partial sell-down of its stake in Scene+ and rumours of a media sale in the past. With CGX highlighting the complementary nature of each segment…

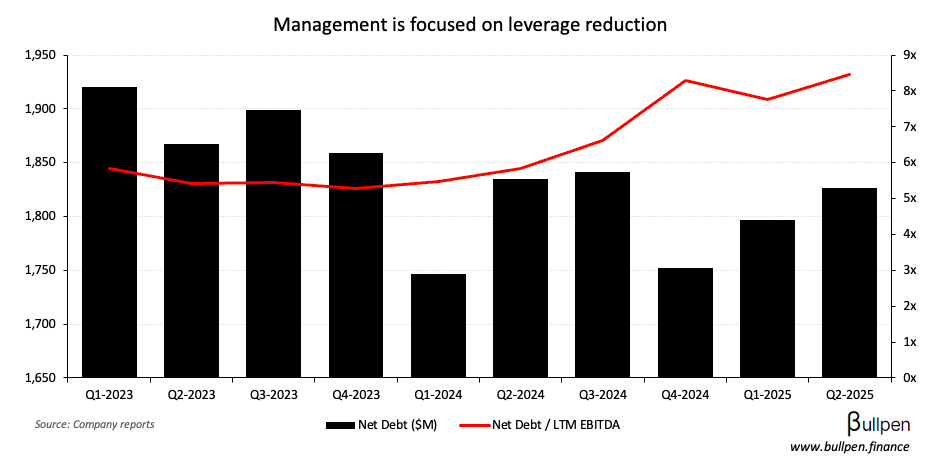

… and making no mention of asset monetization on recent calls, Windward’s H2’25 prediction is uncertain. What is certain is the contrast in operating style, with CGX management sticking to a more conservative, leverage-focused strategy…

… before ramping up a return of capital via buybacks and dividends.

One of those elements is to consider to get more active would be once we sort of hit that $50M cash balance and have the full draw on the operating facility, that would be a trigger.

At $42M in cash as of Q2 and a recent renewal of the NCIB, we’re likely to see some activity in what’s been a dormant buyback program soon - that could put a floor under shares… not a bad setup.

FUNNY BUSINESS

If you have a daughter or a Globe & Mail subscription, you know Taylor Swift just got engaged - and markets are already pricing in the impact… sending shares of Signet up ~3% (U.S. diamond jewelry retailer).

A quick google search tells me there are ~240M Swifties globally (holy sh!t) - if Canada’s share is now inspired to get hitched… who could benefit? There’s a few legs in this trade (only half-joking):

🥂 Celebration: bachelor/bachelorette parties, family events, and of course the big day… all positive for alcohol consumption - good for Andrew Peller (ADW) and Corby Spirits (CSW).

🏡 Family Preparation: as newlyweds move into starter homes and prepare for kids, demand for furniture and child-specific products (ie. strollers) could pick up - good for Leon’s (LNF) and Dorel (DII).

🧸 Kids: as kids come into the picture, so will the need for distraction entertainment and mess management - good for Spin Master (TOY), WildBrain (WILD), and KP Tissue (KPT).

The basket is flat YTD, lagging the TSX by ~14% - let’s see how it does from here… so insane it might work?

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Bradley Wall | NexGen (NXE) | $2.0M |

| Glenn Ives | Kinross (K) | $545K |

| Mario Dubois | Stingray (ONEX) | $124K |

| Lilia Sham | Trisura (TSU) | $100K |

| Robert Shanfield | Onex Corp. (ONEX) | $244K |

Flagging the NexGen (NXE) sale, which brings the insider total to over $16M in August alone and follows some small buying from Brad (Director) in April… when shares were ~70% cheaper.

ON OUR RADAR

GAINERS & LOSERS

|

| ||||

|

| ||||

|

|

The Bank of Nova Scotia (BNS) jumped 7% on a strong Q3, beating revenue by 2% and earnings by ~9% - thanks in large part to lower provisions.

BNS has been in the penalty box recently, with leadership uncertainty and more credit-sensitive international exposure weighing on the stock. With shares trading at a large discount to peers…

… there’s likely room higher if Scotia can continue to execute.

Bank of Montreal (BMO) also beat earnings forecasts by ~9% on more favourable provisioning activity…

… but a good chunk of yesterday’s 5% run was driven by its upsized 30M share buyback program (4% of shares), as BMO looks to deploy excess capital.

MDA Space (MDA) gained 3% on EchoStar’s $23B wireless spectrum sale to AT&T. The cash from the deal improves EchoStar’s financial position, making it more likely for the company to upsize its $1.8B satellite order with MDA.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Bank of Montreal (BMO) | 3.23 | 2.96 |

| 🇨🇦 Scotiabank (BNS) | 1.88 | 1.73 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Royal Bank (RY) | AM | 3.29 |

| 🇨🇦 National Bank (NA) | AM | 2.71 |

| 🇨🇦 Dollarama (DOL) | AM | 1.15 |

| 🇨🇦 EQB Inc. (EQB) | PM | 2.50 |

| 🇺🇸 NVIDIA (NVDA) | PM | 1.01 |

| 🇺🇸 CrowdStrike (CRWD) | PM | 0.83 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | 1.8% | - |

| 🇨🇦 Wholesale Sales M/M | 1.3% | - |

| 🇺🇸 Durable Goods M/M | -2.8% | -4.0% |

| 🇺🇸 Consumer Confidence | 97.4 | 96.2 |

| 🇺🇸 Richmond Mftg. Index | -7 | -17 |

| 🇺🇸 Home Price Y/Y | 2.1% | 2.1% |

COMMODITIES

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 1,000+ professionals from: