Hudson's Bay Company: A Cautiona-Retail

It seems Canada can’t catch a break lately, with the iconic Hudson’s Bay Company (HBC) filing for creditor protection of its Canadian business on Friday afternoon, after 355 years operating in the country. Things get messy after 3.5 centuries:

We dug through hundreds of pages of creditor protection filings to give you clarity on this complex situation, and to help you size up the potential fallout if the company is unable to come out the other side of this restructuring.

Writing was on the wall for Canadian unit

Since HBC’s public listing on the TSX back in 2012, its focus has been on moving up market and south of the border, evidenced by a series of transactions that highlight a shift away from the legacy Canadian business.

Date | Event |

|---|---|

2012 | HBC goes public on the TSX |

2013 | US$2.9B acquisition of Saks Fifth Avenue |

2015 | C$2B JV formed with RioCan to monetize HBC’s Canadian real estate |

2020 | HBC goes private in C$1.1B deal led by chairman Richard Baker |

2021 | Spins off saks.com as a separate e-commerce company, raising US$500M |

2024 | US$2.65B acquisition of Neiman Marcus Group and formation of Saks Global (U.S. luxury arm) |

The shift away from the Canadian business was clear, but the pandemic accelerated it, forcing the company to aggressively cut costs and engage in layoffs. It led to a number of legal disputes too, as HBC fought to withhold millions in unpaid rent to landlords.

The company reported a loss of ~$330M over the past year, and now finds itself heading towards a similar fate to many other Canadian department stores that have come and gone.

Banks should have minimal exposure

At the time of filing, HBC had $1.1B of outstanding debt obligations, likely syndicated among Canadian banks.

RBC appears to be HBC’s biggest banking relationship, though BMO looks to have some credit exposure as well. Other banks were mentioned in disclosures about its cash management system.

As part of its Cash Management System, Hudson’s Bay Canada maintains 46 bank accounts with 28 accounts at Royal Bank of Canada, 16 at the Toronto-Dominion Bank, and two at Bank of America.

Impact should be relatively contained though, with the real estate collateral insulating any material impact to the loan book and a more conservative approach to provisioning in taken in Q1.

Retail REITs have more material exposure

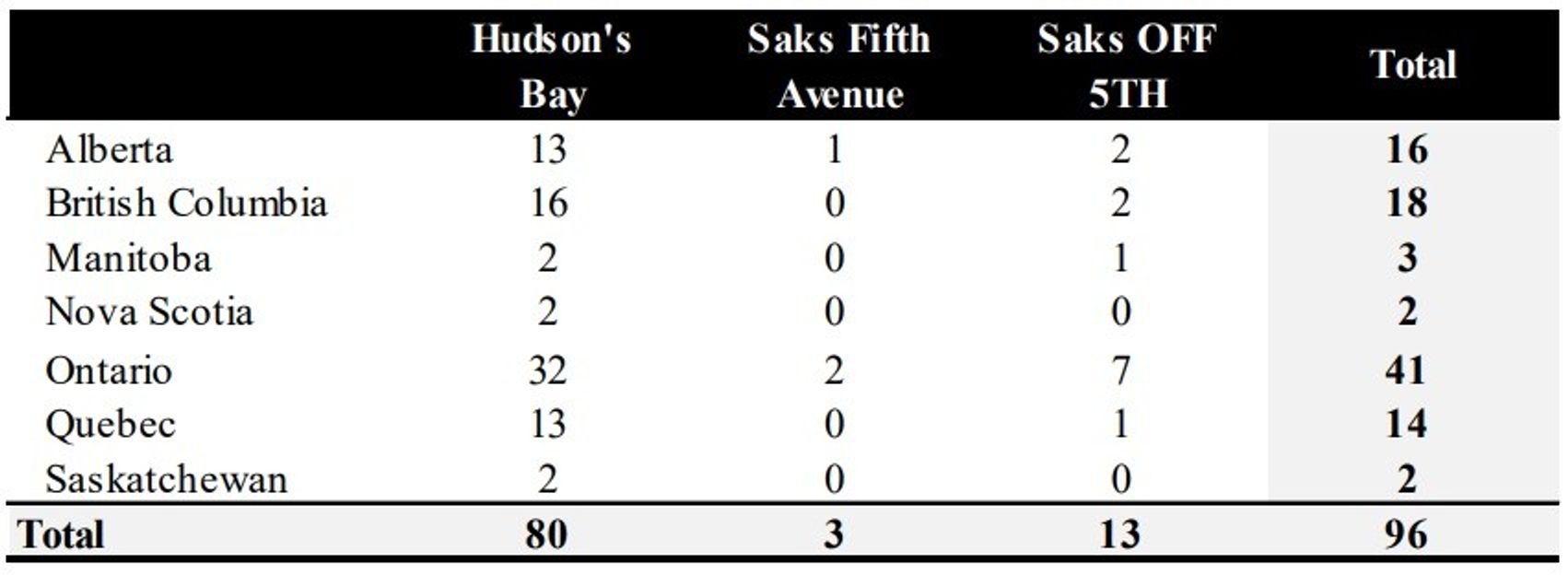

HBC Canada operates 96 locations across the country, with ~90% of its footprint in core markets. While under creditor protection, HBC will continue to pay rent on these locations, though any rent payments it had missed before filing have been halted.

Source: pre-filing report

We looked through the property portfolios of Canadian retail REITs to see who had exposure to these locations.

Company | Properties w/ HBC | Total Properties |

|---|---|---|

Primaris (PMZ-U) | 9 | 27 |

RioCan (REI-U) | 4 | 168 |

Morguard (MRT-U) | 2 | 45 |

While Primaris (PMZ-U) looks to have more exposure than other names, HBC remains outside of its top 10 tenants, meaning it’s likely ~1% of total rent revenue. The impact on occupancy could be greater though.

Given the square footage department stores eat up, they’re harder to replace. If HBC were to vacate some/all of its locations, it could pressure PMZ’s occupancy in the near-term, the same way that Sears did after its 2018 bankruptcy.

RioCan (REI-U) has minimal direct exposure, but could see additional impact from its $1.6B JV with HBC announced in 2015 (REI owns ~20%). While under creditor protection, the JV will not be forced to pay rent to REI, a small hit to revenue.

The company could also face an impairment charge on the portfolio, should the initial carrying value be called into question. Even if this were to occur, it would be an accounting loss only (not an impact to cash flow).

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 500+ professionals from: