Primary Metals Tariff Could Hurt Some & Help Others

This wouldn’t be the first time Trump has taxed Canadian steel and aluminum.

Recall in March of 2018 Trump stuck Canadian steel and aluminum with a 25% and 10% tariff, respectively, and Canada responded with tariffs of its own in May of 2018. The dispute was resolved a year later, but during the tariff period exports dropped almost 20% versus the prior year.

Given the primary metals sector has been a target before, it seems a likely target this time around too. With that, we think it would be worthwhile to examine potential winners and losers in a tariff scenario.

Demand will be the main driver

In the next few sections, we’re going to view the impact of tariffs in isolation, but the reality is much more complex. Some points to consider:

The good:

Trump administration wants to reignite growth in domestic manufacturing and oil & gas activity

The Canada S&P Global Manufacturing PMI rose to the highest level (52) since February of 2023, the 5th consecutive month of expansion

Data center buildout remains a global tailwind

The bad:

Tariff disputes could result in more cautious buyers

China’s real estate market (a huge consumer of steel) is struggling, with housing starts down over 20% y/y in 2024

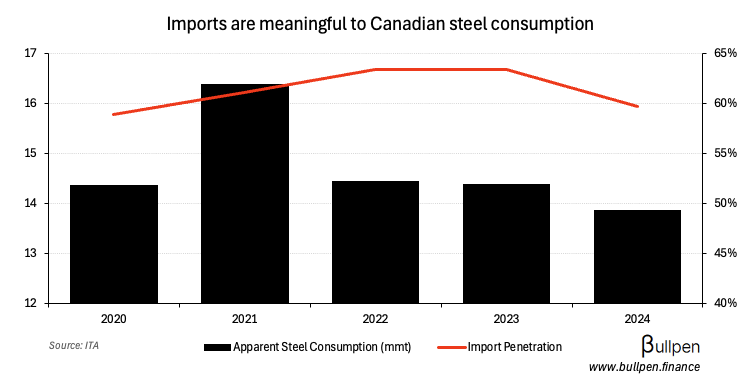

Chinese steel exports reached their highest levels since 2016, indicating oversupply in the region

Understanding the value chain

The value chain for Steel & Aluminum is relatively similar, so we’ll walk through steel - starting first at raw material extraction (miners of iron ore), flowing through to producers who refine the iron ore into steel and turn it into products (sheets, plates, etc.) before sending them to a processor who fabricates specific products (beams, pipes, auto parts, etc.). Finally, a distributor will handle the logistics of getting the end products into the hands of their customers, of which there are many.

Miners will be price dependant

All else equal, the price of steel and aluminum would likely climb in a tariff scenario, making mining operations more economical.

There aren’t many ways to play iron ore in Canada beyond Labrador Iron Ore Royalty Corp. (LIF), which has a 15.1% equity interest in the Iron Ore Company of Canada (IOC) as well as a 7% royalty agreement and $0.10 per tonne commission in place.

Any price upside (or downside) should be reflected in IOC’s results and flow through to LIF’s financials via the royalty.

Canadian producers get hit regardless

With tariffs making the cost of Canadian steel less competitive in the U.S. market, companies like Algoma will have a tough time moving product south without taking a margin hit.

The last time these tariffs were in place, an Ernst & Young representative estimated the net cash impact was $55M in the first 3 months alone (ASTL was private at this time). Since being a public company, the U.S. has become a bigger share of ASTL’s total book of business, leaving it more exposed to tariffs than before.

If retaliatory tariffs were put in place by Canada, though, it could open up the domestic market for Canadian producers like ASTL to help backfill some of its lost U.S. business.

Processors & distributors have less exposure

Generally speaking, the processing and distribution business is a scale business, given the benefits of easier negotiations, proximity to customers, and operating leverage.

As such, the larger players like Russel Metals (RUS) don’t do much cross-border trade if any, sourcing their key inputs from suppliers close to facilities to reduce transportation costs and lead times and in turn, reduce exposure to a tariff scenario.

Given that most of its revenue comes from value-added products, margins tend to be more defensible in a downturn, leaving sales volume as the main vulnerability. With a growing energy business, RUS could be insulated from potential volume deterioration.

End markets could see cost pressure

The end consumers of steel and aluminum products could face headwinds from rising input costs, resulting in margin compression.

There is a long list of companies that fit the bill here, but we’ve handpicked a few of them that would have exposure and were impacted the last time we saw tariffs:

NFI Group (NFI): bus, and other auto manufacturers in North America could see near-term margin compression from a rise in steel and aluminum costs due to tariffs.

Hammond Power (HPS-A): transformer manufacturers like hammond power could see some near-term margin compression given steel and aluminum are key inputs, though costs would likely be passed through over time.

ADF Group (DRX): engages in the design, engineering, and fabrication of complex steel structures for commercial infrastructure, and was impacted hard the last time tariffs were implemented.

Get smarter on Canadian markets

Get our insight-packed coverage of Canadian markets delivered to your inbox 3x per week in 5 minutes or less.

You might be interested in...

Get smarter on Canadian markets

Get The Morning Meeting, our insight-packed Canadian markets newsletter delivered to your inbox 3x per week in 5 minutes or less.

Read by 500+ professionals from: